A reader recently asked me if I knew of any good and free budgeting spreadsheets – specifically, a household budget template for Excel.

Personally, I love Excel and get a kick out of building spreadsheets, but I know not everyone is as interested in that as I am. 😉

But whether you like to create spreadsheets or just like to use them, we have a lot of good options for you!

Household budgeting Spreadsheets

Here are all the personal budgeting templates listed in no particular order. If you want to see them in action, you can check out this video here.

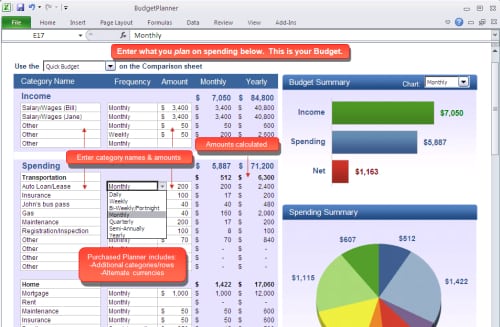

1. Premium Budgeting Spreadsheet

This is my favorite Excel sheet I have found, but the downside is that is only a free demo, but the full version is $15.

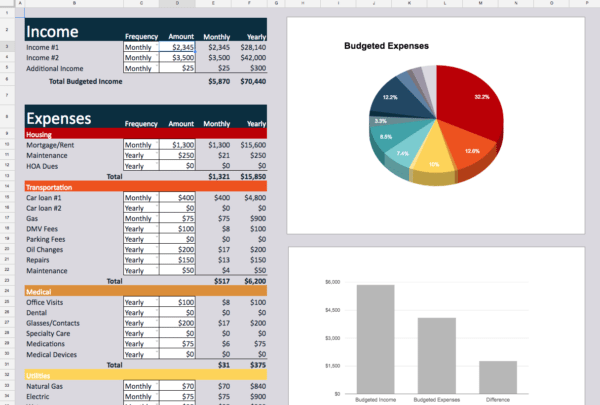

2. Household Budgeting Spreadsheet

This user-friendly Excel family budget template has just the right amount of features to help you get your budget in order.

Download: Click here to download

3. Financial Snapshot and Budget

A colorful and easy way to track your budget and overall Financial Snapshot!

Download: Excel File (XLS) | Google Docs

4. Williams Budgeting Sheet

A monthly budget spreadsheet complete with written and video tutorial on how to use it. Also has a handy fuel calculator.

Download: Newsletter sign-up required

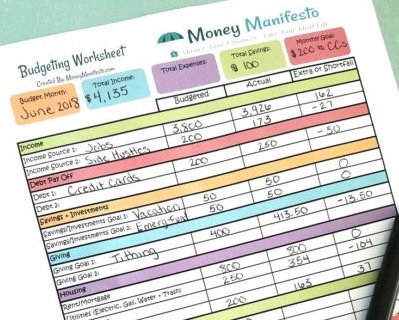

5. Free Budget Template

This one is a spreadsheet and includes a PDF budgeting worksheet version as well. It was created by a CPA, so that says something right there.

6. Zero-Based Budget Spreadsheet

This one is good if you are trying to add up income and expenses and find the difference between the two.

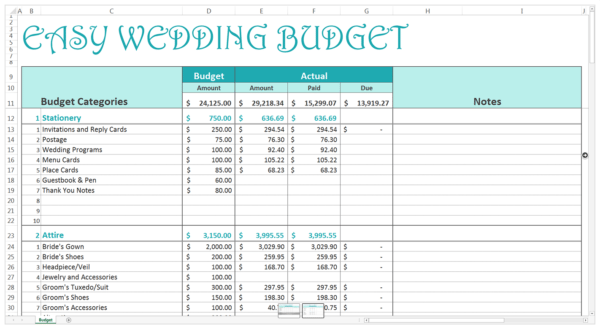

7. Wedding Budget Template

This sheet provides you with all of the possible categories to create your wedding budget, a place to estimate your spending as well as track your actual spending.

8. GLBL Budget Spreadsheet

It is different than most because it works by pay period rather than by month.

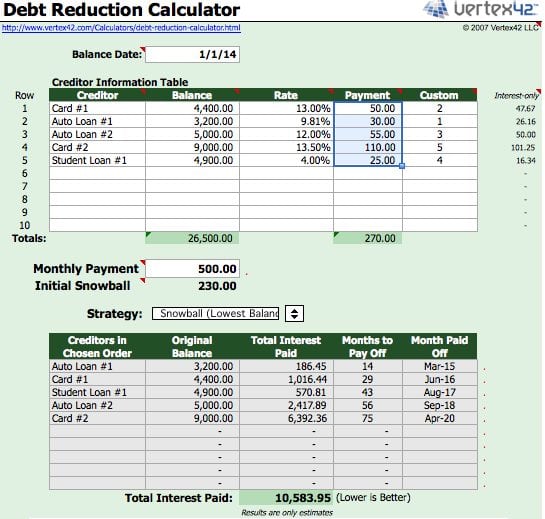

9. Debt Reduction spreadsheet

This is a really cool spreadsheet that helps you decide the best method for paying down your debts. It allows you to create a debt reduction schedule based on the debt snowball method. The first page is a basic calculator for you to enter your information, choose your total monthly payment, and see a summary of the results based on your debt reduction strategy. The second page is a printable payment schedule to help you keep track of your progress.

10. Personal Budget Worksheet

A famous old Microsoft budgeting template. It is very simple but has proven to be helpful, with the 2,000,000+ downloads. I like this one because all it does is provide a sheet to add up your expenses and your income, showing the difference.

11. Personal budgeting spreadsheet

A good and simple budget spreadsheet. The user has to enter each purchase and details in order to get full and accurate tracking of daily expenses.

Download: Excel File (XLS) | Google Docs

12. Not exactly a budgeting spreadsheet

And since we are talking about free spreadsheets, I will tell you about one I built and use. It isn’t necessarily for budgeting, but it really helps keep our finances organized.

FLOP (Financial Life on One Page) – Basically, my balance sheet to calculate my Net Worth, and keeps track of account numbers and other information about all my financial accounts.

How to set up a winning budget today

If you want more handholding and specific instructions on how to set up a budget you can actually stick with, then check out our Real Money Budgeting online course. It is a simpler, easier, and more effective alternative to traditional budgeting. So, if you have struggled with budgeting in the past and just want a simple solution that works, definitely check it out.

More thoughts about household budgeting

If you are just getting started budgeting, I suggest reading two articles I wrote – How to make a budget and why budgeting is like baking cookies. From personal experience, I can assure you that you won’t get it right the first month. It’s okay, just keep making adjustments, and it will get better and easier each month.

Budgeting of some sort is critical if you want to master your finances or get out of debt.

If you are just starting, I wish you all the best, and let us know about what you learn in the comments! Also, be sure to check out the article I wrote listing 15 places to get free budgeting software.