12 years ago, Linda and I confronted our debt and decided that we were going to pay off our credit card debt on our own (and fast if at all possible).

We were determined to make the sacrifices necessary to eliminate it as quickly as possible.

We had $46k in total debt (though not all was credit card debt), and we created a makeshift debt-payoff plan that guided us to becoming debt-free.

In our case, we were a little extreme (like budgeting only $45/week for food), but we really wanted to get our credit cards paid off ASAP!!

The good news is that for most people, you don’t have to make massive lifestyle changes; you can take the slow and steady approach. It may take longer, but it will be a little less painful. Ultimately, it is up to you how fast you pay off your debt.

Looking back it was so clear that God was involved in the process. The miraculous speed with which we paid off our debt can only be attributed to God. As we stepped out in faith to pay off our debts, He came in and helped us pay it off so much quicker than I had calculated. Unexpected sources of income came in multiple times and shaved years off our debt payoff plan.

Free PDF Download

Table of Contents

This exhaustive guide is really more like a short book (and you can just click here to download the PDF version), or to make your life a bit easier you can click the links below to navigate through.

The problem with debt

Anyone who has really felt the effects of their debt can understand why the Bible says that the “borrower is slave to the lender”.

The weight of that burden can have terrible consequences.

Our Marriages

As we all know, money fights are one of the biggest stressors on our marriages, and they are also one of the leading causes of divorce.

Our Joy

According to a 2007 survey by the American Psychological Association, Money problems are a leading source of stress for Americans.

Our Sleep

A recent study found people with high levels of debt were more than 13 times as likely than low or no-debt people to lose sleep at night.

Our Physical Health

studies have found that high debt levels are associated with a wide range of illnesses including ulcers, migraines, high blood pressure, and heart attacks.

And with all these terrible side-effects, it is no wonder that so many people are choosing NOT to take on any more debt and trying to figure how to get out of debt as fast as possible.

9 Benefits to Getting Out of Debt

Check out this video for 9 of the best benefits we have found from getting out of debt:

How to get out of credit card debt on your own and fast

In this article, I am going to focus specifically on credit card debt, but the methods should work for most types of debt: student loans, auto loans, and even some medical debt.

And just so we are clear, this isn’t theory for me. These are things that Linda and I lived through and did ourselves when we were working to pay off our credit card debt.

Step 1: How much debt do you actually have?

Maybe you have been choosing to not confront your debt and look to see how much you owe?

If that”s you, it is time to face the facts and add it all up. You can’t win this battle without knowing what you are up against.

I”ve been there, and I remember burying my head in the sand and hoping that somehow it would all just go away.

But, as you probably know, that doesn’t work. The longer we do that, the worse it gets, and it has to be dealt with at some point.

And like I mentioned, God was fighting our battle alongside us, but I don’t think we would have seen that if we hadn’t been honest and acknowledged our “mountain.”

“Truly I tell you, whoever says to this mountain, Be lifted up and thrown into the sea! and does not doubt at all in his heart but believes that what he says will take place, it will be done for him.” Mark 11:23 AMPC

Tell the mountain how big your God is

When you are looking at an overwhelming amount of debt that you need to pay off, it can be easy to just constantly focus on how big the mountain is.

But just like David running towards Goliath, our strength is in our declaring to the mountain how big our God is!

Our testimony is that God miraculously helped us go from paycheck-to-paycheck living to pay off $46k on our tiny salaries. And ours is nothing compared to what I have heard from some of our readers.

Running this website for the last decade, I have seen some miraculous stuff in the lives of our readers and let me tell you that there is no amount of debt too big for God to handle!

Almost every debt-payoff testimonial I have heard involves work towards the goal, rather than God dropping a check in the mailbox (though that has happened).

nearly every Christian testimony I have heard about paying off debt had a similar story to ours in that they stepped out in faith and God came in to amplify and speed up the debt payoff process.

It reminds me a bit of Peter walking on the water. He had to take that first step 100% on faith that Jesus would support him. Surely there were fears and doubts in his mind, but he chose to trust in his Lord.

The other disciples never stepped out of the boat and missed out on the testimony that Peter will always have that he walked on water.

Let me encourage you that though you may be staring at a huge mountain of debt right now, God is bigger and is able to take care of it in ways that you and I will never be able to imagine.

BUT…

We have to step out of the boat to see those miracles.

Homework: Add it all up

- Create a simple Google Spreadsheet (or paper) and add up every piece of debt you have.

- Tell your mountain how big your God is!

- Extra Credit: Spend an extra 10 minutes and use our balance sheet spreadsheet to identify your net worth.

Step 2: Quit spending

Plug The Holes

If you were in a boat in the middle of the ocean and you noticed that water was coming in through a hole, would you spend your time scooping the water out over the side of the boat, or would you plug the hole?

Getting out of credit card debt uses the same principle. Our spending is like the water coming into the boat, and the way to fix it is to QUIT SPENDING!

Yes, it is obvious, but it needs to be repeated because for some reason our brains can realize that it is true, but not do anything about it. So our goal now is to plug the hole, stop the bleeding, whatever you want to call it: just quit spending.

Spend Less Money Than You Make

Getting out of debt, creating wealth, living financially free, and retiring with some cash in the bank can all be achieved by following one simple rule:

Spend Less Than You Earn

If you do everything else wrong, but get this correct you will still be okay.

But, the scary truth is that if you do everything else right, but get this wrong you will end up deeper in debt.

It is very simple, but it is not easy.

It is the only way to stay debt free. It is the only way to have any lasting wealth.

It doesn’t matter if you get $10 million from lottery winnings; if you can’t follow this simple rule you will be back to where you started in no time (and often even worse.)

It doesn’t matter how much you make. Everyone (I used to do this too) thinks that when they make more money, they will be able to spend less than they earn. Rarely is this true.

We all know someone who no matter what time something starts you can count on them being 15 minutes late. It doesn’t matter if they have the entire day free, they will still be late. It isn’t a matter of the time available as much as it is a matter of discipline. It is the same way with our spending.

If you can’t spend less than you earn with what you have now, you will not be able to when you get more. Parkinson”s law states that “expenses rise to meet income.” So without a deliberate and intentional effort, each increase in income that you get will quickly be used up by new expenses.

This is the frustrating part about getting a raise. As much as I loved getting them, they never seemed to make bill paying any easier.

Have you ever felt this way?

So I Know I Need To Spend Less Than I Earn, But How?

Make A Budget

A budget is absolutely one of the best tools that you will find to help you spend less than you make. I have written extensively about how to budget, but I suggest you start with this post ”“ how to make a budget or take our Real Money Budgeting online course.

It will walk you through all the steps you need to get started on an effective budget. If you are really serious about getting out of debt, don’t skip this step.

You also might want to download one of our free budgeting spreadsheets while you are at it.

Everyone who does not budget spends more money than those who do. It is as simple as that. It doesn’t have to be painful and can even be fun.

Eliminate The Temptation To Spend

Look at your credit card statements and see where you are spending more than you think you should be.

Romans 13:14 says to ”make no provision for the flesh in regard to its lusts.”

I did this by not going to the mall and not going out to eat.

These were my two problem areas where I spent way too much money. Find out what your temptations are, run from them and set yourself up to succeed.

Alcoholics shouldn’t hang out in bars, and over-spenders shouldn’t go to Target! Just ask my wife!

For more check out how to quit spending more than you make. Additionally, you might want to check out my favorite ways to save money.

Step 3: Making sacrifices

This one is where the rubber meets the road. If you are one of the bold ones who has a lot of debt but wants to pay off all your debt in a year, then this is where you can make some huge headway!

The Sacrifice Is Only Temporary!

The most important thing to remember as you are reading this is that it is ONLY TEMPORARY.

By making a sacrifice, you are not condemning yourself to that for the rest of your life. You just need to make up for all the overspending that has taken place in the past.

If you have done some of the things mentioned above, then you are already on a better financial footing than you were.

But, if your expenses are still greater than your income, then we are going to have to take a few more steps.

Sacrifice Your Stuff And Sell It!

To get this debt paid off – especially if you want to do it fast, then you are probably going to have to sell some big stuff.

The truth is that you either have to cut more expenses or increase your income.

Depending on how deep in debt you are, you may need to take drastic measures to get yourself back on solid ground.

What do you have that you owe money on?

Take out a piece of paper and write them down. Do you have loans on your house, car, boat, living room set, or anything else? The goal is to minimize our expenses, so what better way than getting rid of some of the stuff we owe on?

Don’t worry, you will be able to get it again later, but now your goal is to break free from the bondage of debt!

You have to open your mind to things that you might not have wanted to do. This is probably one of them.

Cars Are Terrible Investments!

Like we”ve talked about before, we pay a lot of money for cars and they basically only go down in value until they are sent to car heaven.

Like we”ve talked about before, we pay a lot of money for cars and they basically only go down in value until they are sent to car heaven.

In my opinion, cars get people into financial trouble more than anything else.

Most people don’t spend tens of thousands of dollars on something that knowingly goes down in value.

The way to defeat this is to drive older cars (older cars have already suffered much of the depreciation and therefore lose a whole lot less in value each year).

Now I know everyone”s situation is different, but the goal is to get you to start asking, “what if we sold _______?”

So, if you have a boat that you owe thousands on still or a couple of cars, it doesn’t really matter; if you are making payments on it, you should consider getting rid of it.

And come to think of it, if you do own it and it is still worth a decent amount, you can sell that too!

“But If I Get An Older Car, It Will Be Expensive To Maintain.”

Not necessarily. Go to Consumer Reports and give them $6.95 for one month of access to their website. They have hands down, the best and most useful information for buying a used car. They rate just about every car in the book for all kinds of criteria. Not the least of which is reliability.

What I have found over the years is that Honda and Toyota (on average) have consistently made the most reliable cars.

But, do your own homework at Consumer Reports.

Sacrifice your time and get to work! Again.

Yep, if everything up to this point isn’t giving you some extra cash to help you get out of debt, then you may need to think about getting a second job.

The good news is that second jobs aren’t what they used to be. I remember when I was younger I would put in a hard day”s work at the grocery store and then make my way to the restaurant for the completion of about 12-16 hours on my feet.

Needless to say, those days were very tiring, but it doesn’t have to be that way. Thanks to technology there are so many legit ways to make money these days, many home-based businesses you can start, or a bunch of real companies that will pay you to work from home that you could work with temporarily as you knock out your debt.

Work Overtime

Ask your boss if he/she has anything extra you can work on to pick up some extra hours. This will likely be the best paying additional income you could find.

Sell On eBay

This is probably the most popular method these days for people looking to supplement their income. The greatest part about it is that you can start with stuff laying around your house. If you have not sold on eBay before, I highly recommend it as a way to generate some extra income.

I wrote all about my experience of how I made $2,145 in one month selling on eBay and Craigslist. Or for more info, you can read the earlier article I wrote for beginners called 7 Steps to selling on eBay.

Should you sell your house to pay off debt?

This really is the epitome of selling everything to get out of debt! This is a tough one. It really will depend on your situation. I have personally known a few people who have sold their homes to get out of debt, and they all seemed happy that they did.

But, you have to remember that it generally costs a good amount of money to sell a home and move to a new place. Not to mention all the time involved.

You might be one of those people in a situation where selling your house and moving into an apartment for a while makes sense. But if you are unsure, definitely seek wise counsel about the details of your specific situation.

Should you cash out your 401k to pay off your credit card debt?

Like the previous question, this one depends on your situation. First off, if your 401k is at your current employer, you won’t even be able to unless you qualify for Hardship Withdrawals.

Additionally, even if you can, you will have to not only pay taxes on the withdrawal, but also a 10% penalty (assuming you are under 59 1/2 years old). You might be able to avoid that if your medical debt exceeds 7.5% of your Adjusted Gross Income.

If your credit cards are charging you 25% interest, it could make sense in some cases as you likely aren’t earning near that much in your 401k. But you are also giving up the long-term earning potential.

Bottom line, this is another one where you will want to seek the wise counsel of a trusted advisor who truly understands your debt situation.

Should you stop tithing while paying off your debt?

I won’t go into this much here because I already wrote about my thoughts on stopping tithing while paying off debt.

But suffice it to say, as mathematically counter-intuitive as it seems, we continued tithing while we were paying off our $46k and we paid it off way faster than our payoff timeline suggested.

We had surprise income come to us multiple times, and I am convinced that if we had stopped tithing, it would have taken us LONGER to pay off our debt.

What sacrifices are you going to make to get out of debt?

Tools to help you get out of credit card debt

DIY Debt Consolidation with Balance Transfers

I don’t recommend this for a lot of people because you can get yourself into trouble if you don’t stay on top of things.

But we used this method (in the video below) when we were paying off our $46k of debt. Essentially I transferred all our debt (credit cards and car loans) onto 0% credit cards to save a ton on interest charges.

Debt consolidation with Lending Club

This is a much simpler way to reduce your interest rate than the balance transfer method mentioned above.

You won’t be able to achieve 0%, but if you have credit cards with interest rates in the range of 20%+, you should be able to get them greatly reduced.

I wrote a thorough article documenting how to do a debt consolidation with Lending Club that you can read for more info.

Debt Snowball spreadsheet or calculator

This is the “get out of debt plan” I generally recommend. For most people, it is simply the best way to get out of credit card debt.

Though it takes you a little longer to pay off the debt, it isn’t much longer, and there isn’t any risk of making things worse (like the balance transfer method above). And the quick, small victories are really motivating.

We have full details about this debt payoff plan here: Free Debt Snowball Spreadsheet & Calculator.

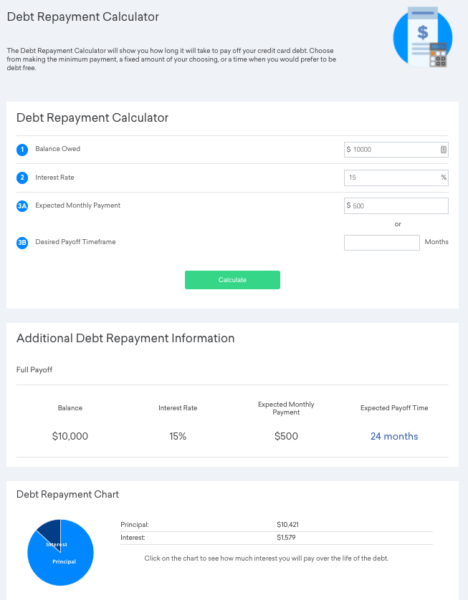

Pay off debt calculator

If you are wanting to see how long it is going to take to pay off your debt, I found a free calculator that you can use.

You just drop in a few details (balance owed, interest rate, monthly payment) and off you go!

Desktop backgrounds

A couple of years ago, we created some desktop backgrounds for our students and I personally still use them. I love regularly seeing quotes or bible verses that inspire me, and this is a simple way to do that. The two below are specific to paying off debt, so they are yours to download and use!

Getting out of debt is not a one-time decision

I wish getting out of debt, losing weight, and exercising were one-time decisions, but they are not. They need to be decided over and over again.

Every time you get tempted to buy something you don’t need, or have a potluck at work, or just feel like sitting on the couch ”“ you have a decision to make. Are you going to do what you should do, or what you FEEL like doing?

You probably know what most people do most of the time ”“ what they FEEL like doing. You are obviously different. You wouldn’t still be reading this if you were like most people.

So, you may have “decided” to get out of debt, but as you go on this journey, there will be some tough days where you feel like quitting.

I know I had plenty of them.

The thing that helped me was continuing to dream of my “promised land.” For me that meant dreaming of:

- Eliminating all the money stress I had

- Having an emergency fund (so I didn’t need to depend on credit cards)

- Being able to give generously like I had always wanted

- Being able to travel all over the U.S.

- Having fewer money fights with Linda

So figure out what your KEY motivations are for wanting out of debt – your “Promised Land” – and focus on that on the tough days.

As someone who has been through it and has interacted with thousands of other readers who have, let me assure you that by God”s grace you can do this!

Getting out of credit card debt is a bigger deal than you realize

I believe that God put each person down here for a reason and that reason is to bless others. In doing so, we will be blessed.

I have found in my own life that my most joyful moments often revolved around me helping or doing something to benefit another person.

Meanwhile, my most painful, sorrowful, and sad moments were taking place when I was thinking about myself. Often one of the quickest remedies to a struggle that we are having is to get our minds off ourselves and go do something for someone else.

So what does this have to do with getting out of debt? A whole lot actually.

Our motivation for wanting to get out of debt should go beyond ourselves.

Sure, it will be awesome when you get to break out of the paycheck-to-paycheck cycle and when you can buy that car with cash, but that is just part of it.

God wants to use you to financially bless others! This is a very good thing because:

- Giving is one of the most fun and self-fulfilling activities you can be part of.

- You are storing up treasure in Heaven for eternity, rather than down here for a few more years (Matthew 6:20).

- Giving is a great way to burn selfishness out of your life.

- When you give, it will be given back to you in abundance (Luke 6:38)!

You need to have it to give it!

If you are like most Christians I have met, you want to be able to give more. You have a good heart and wish you could give more. You really want to be able to bless people and give more to your church.

But again, if you are like most that I have met, you are thinking, “it is hard enough just to pay the bills each month, let alone give to others the way I would like to.”

This is exactly why you need to get out of debt!

Imagine how much easier it would be to give if you didn’t have any credit card payments or car payments, or (dare I even say it) a mortgage payment! This has been my motivation over the last few years and this is where you and I are headed!

It is not actually our money

One of the biggest financial revelations that I have received is that our money is really not our own. We are merely stewards of what we have been given by God (read the Parable of the Talents for a refresher.)

Even if we insist on saying that we worked hard to earn it, who gave us our brain, the hands we used, and even the air we put in our lungs?

We came into the world with nothing; we will leave with nothing. It is all God”s (Psalm 89:11). We have the privilege of being stewards. When we are slack or wasteful with our money, it is not our money we are wasting, but God’s. It is not only ourselves that we hinder but others as well.

Fund the Kingdom instead of paying interest

What if we took all the money we were paying in interest charges to our credit cards each month and gave it to missionaries and charities making an impact?

It would be the most painless giving because the money wasn’t even coming to our pockets in the first place! It would simply be transferring that money from Visa and Mastercard to organizations that we WANT to give it to.

Can you imagine how many lives would be impacted? Can you imagine how many souls would be impacted?

I will be the first to tell you that getting your credit cards paid off feels absolutely liberating and amazing, but what if we could add to that the additional motivation to get out of debt to benefit the Kingdom of God?

Ultimately, we have a part to play, and so does God (1 Corinthians 3:9).

But I can’t help but dream about how much more effective we could be if we were out of debt?

Psalm 67:7 “God blesses us, that all the ends of the earth may fear Him.”

The importance of having an open mind

Our greatest battles as Christians are in our minds.

I have found that the greatest breakthroughs in my life came as a result of opening my mind to a new way of thinking. It requires humility to admit that something you have always done or always thought is not necessarily the only way or that it is even correct at all. These mindset changes can be very difficult, but they are absolutely essential to follow God and accomplish anything worth accomplishing in life.

What does this all have to do with paying off my debt?

Maybe it will be easier for you, but for me, I had to change a lot of old mindsets that I was holding onto in order to dig out of our debt.

Just a few:

- I decided to give up my hard-earned free time after my 9-hour workday and use that time to start a business to earn extra income.

- I would go out to dinner with friends but didn’t order anything because we didn’t have the money in the budget.

- I had to learn to cook at home, as our food budget shrank to a tiny amount.

- I had to sell off some items that I truly valued.

- I had to choose NOT to care what people thought about me as I drove around in a 14-year-old car.

Anyway, these were just a few that I had to fight through. Yours might be different. But the thing you have to remember is that it is only temporary!

None of those things listed above lasted more than 2-3 years for me.

And looking back, I would do it again in a heartbeat if I had to.

Being out of debt has been so much more liberating, fulfilling, and financially beneficial than I ever could have imagined.

Now it is time for you to take action!

Bookmark this and come back to it each month or as needed.

And whatever you do, don’t quit until you reach your goal!!!

Quick Favor:

If you know anyone else who might be trying to figure out how to get out of debt, I would love it if you shared this with them.

I poured my heart out into this monster-article because I want it to help as many people as possible. My prayer is that it would get into the hands of whoever would really benefit from it, so any kind of sharing with others is greatly appreciated!!

Prayer to get out of debt

I”ll leave you with this prayer.

If you”re in debt and want to get out, spend a moment praying for God”s help:

God, I know You can do all things, and that I can do all things through Christ who gives me strength. I want to get out of debt, but I need Your help. Lead me by Your wisdom as I begin this journey. Help me change my habits and my mindset. Work through me and others so I can eliminate all of my debt. Lead me to a place where I can be in a position to give more to others.

For Your glory and in Jesus” Name,

Amen