With an increasing desire for many to escape the rat race and work from home, many people are trying to start a home-based business.

With an increasing desire for many to escape the rat race and work from home, many people are trying to start a home-based business.

Working from home not only offers independence and freedom but there are also some great home-based business tax deductions as well.

As I sit and write this, I am reminded of the years I spent in jobs that I didn’t like and am now so thankful that I get to work from home and do something I love.

If you are longing for that situation, I encourage you to work to figure out what it is that you would love to be doing and keep at it until you reach that goal.

For my business (blogging here at SeedTime) it took a long time before I started making any money blogging, let alone enough to pay the bills each month. I didn’t really know anything when I started and still feel like I do a whole lot more wrong than right, but the one thing I have had going for me is that I have been persistent.

Great ideas and business degrees only go so far. It is persistence and determination that, I believe, are the true sources of success for most businesses.

I put together a list of legitimate home-based business opportunities below.

But they are just ideas – hopefully they will spark some inspiration, but you have to apply all the diligence and hard work to turn it into something.

Starting a Home-Based Business

Table of Contents

Even though I wasn’t making very much at the time, when I got laid off in 2008 I was very happy that I had started a side business that was another source of income. Even if you don’t have aspirations of working full-time from home, having a little supplemental income would be nice – wouldn’t it?

Below are a bunch of home-based business ideas that you can peruse to see if any would work for you.

Oh, and also as an aside, I am defining a home based business as one that can be run from home, not necessarily a business that you would work from home all the time.

Top Home-Based Business Ideas

1Turn your blog into a business

I guess we should start with the one that I am MOST familiar with. I have been making a full-time living blogging for almost 10 years now, and it isn’t a get-rich-quick scheme, but it can definitely make you some money.

I guess we should start with the one that I am MOST familiar with. I have been making a full-time living blogging for almost 10 years now, and it isn’t a get-rich-quick scheme, but it can definitely make you some money.

I actually wrote a short book that explains how I replaced my day-job with my blog ”“ and even though it sells for $5 on Amazon, you can get it FREE here.

The book covers the basics of getting started as well as how to get traffic and how to earn from it as well.

2Earn $100k/yr cleaning parking lots

One of our readers sent this suggestion in and it looks like a great home business opportunity, especially if you enjoy being outdoors! Here is a quick video showing how it works:

Check out Cleanlots to learn more!

3Sell a product online

A friend of mine had a baby and didn’t like the style/design of any of the baby products at the stores, so she started making her own. After getting some compliments, she realized that she could turn her idea into a business that she could run from home (with the babies).

She just created an online store and sold all of her products via her website. If you aren’t creating your own product you can always find a product to dropship – that way you don’t have to store any inventory in your home.

4List your place on Airbnb when you go out of town

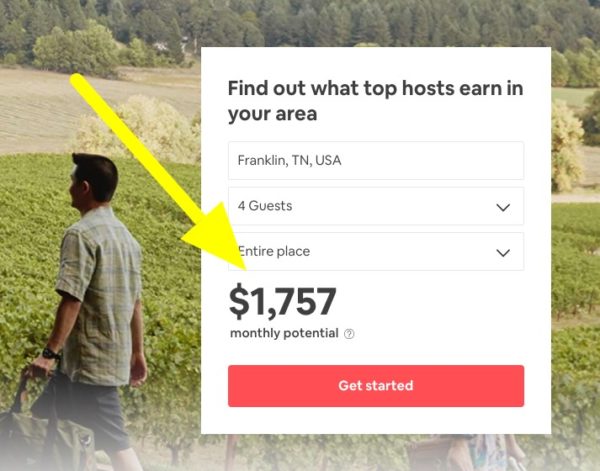

This really isn’t as scary as it might seem. You maintain full control and can filter out anyone you might not want renting your home. And you can even rent out individual rooms of your home.

Curious? Click here to see what you might be able to earn in your area.

When I checked I was shocked to see that I had a $1,757 monthly potential in my area.

You can list it as often as you want and can list it to be by the night, week, or month. Airbnb offers a $1,000,000 guarantee to protect you from any kind of property damage that may be caused by guests.

They also have a guest rating system, so you can choose whether or not you want to approve that guest to stay in your place.

Check out the video below for more information:

5Driving for Lyft

So, have you ever thought to drive for Lyft?

So, have you ever thought to drive for Lyft?

Depending on your city you can make over $20/hour all while having 100% control of your schedule.

If you don’t know what Lyft is, basically it is the 21st-century version of the taxi. You just use your own car and when someone near you wants a ride you get a notification on your phone (assuming you selected that you were available in the app) you go pick them up and drop them off where they want to go and then you automatically get paid.

6Freelance writing

Since I started blogging, I have seen the freelance market explode. There is a huge demand for content and so there are a lot of ways to make money writing it. Jonathan wrote a great article about a few legitimate work from home jobs – most of which were freelance writing.

7Goodwill/Garage sale reseller

There are a lot of items that can be purchased very inexpensively at garage sales or thrift stores and sold for higher prices elsewhere. A few years ago I discovered that I could purchase good hardcover books at my local thrift shop for $1 or less. I realized that some of them could be sold on Amazon.com for $15-$20, which turns out to be a pretty decent profit.

Here is a quick breakdown of how it works:

8Ebay Business

8Ebay Business

Several years ago I started an Ebay business kind of as an experiment, just to see if it were something I could do if I needed cash.

I wrote step-by-step instructions about starting an Ebay business if you are interested. Ebay is a pretty crowded market, but it still is one of the most popular home-based businesses.

9Home Inspector

This one will require certification, find out more about getting certified here.

10Real Estate Agent

This one isn’t technically a home-based business, but with the flexibility it allows you would be able to likely do a lot of work from home.

11Tutoring Students

What subjects do you have a good working knowledge of? Math, Science, History, Baseball, Soccer? Parents will often pay to see Johnnie or Sally excel at _______. If you can help, then it sounds like a business.

12Start a Christmas Light Hanging business

If you aren’t afraid of heights and can handle being out in the cold, this is a pretty great business opp. Some people earn a full-year’s salary just hanging lights for 2 months each year.

One of our readers took this idea and ran with it and created a really nice season income for himself.

13Car Mechanic

Do you know how difficult it is to find a good and trustworthy mechanic?

Maybe it is just me, but I feel like I have had way too many experiences with mechanics not be truthful with me that I would gladly pay more and give all my business to an honest one. If you know your way around a car and have a few tools, this could be a great business idea for you.

14Mobile Oil Changes

Building off the previous idea, what if you offered a service where you came to the customer’s house and changed the oil in the street? I would pay to do that – and would be willing to pay more since I didn’t even have to do anything but make a phone call.

15Wedding Planning

Isn’t this every girls dream? People will always be getting married, so in theory they will always need wedding planners. If you love all-things-weddings and can handle the pressure from the brides, this might be a fun one.

17Medical claims billing

This industry is one of the most popular work-from-home businesses. You can find training courses online at places like eLearners.com

18Start a Daycare

If you love kids and are uniquely gifted with a lot of patience, you could always start a home-based daycare.

19Handy-man service

If you are handy, there are lots of little old ladies who are willing to pay someone to do odd jobs around the house. There are even franchise opportunities available with certain companies.

20Lawn Care

Don’t forget good ‘ol lawncare or landscaping. As we become more and more acquainted to the air-conditioned lifestyle more people are going to want to pay someone to do landscaping. If you like to sweat this one may be for you.

21Photography

Because I am just a little bit techie, I get asked to video record weddings all the time. If video or photography are up your alley, starting a wedding photography business could be a great idea for you. If doing weddings aren’t your thing, there are other ways you can make money as a photographer as well.

22Virtual Assistant

Virtual Assistants are just like a secretary in another part of the world. This industry is growing very quickly. Check this out to find out more about being a virtual assistant.

For opportunities, go to this site and search for “virtual assistant”.

23Window Cleaning Business

A lot of businesses (and homeowners) need windows cleaned. If you are not afraid of heights, cleaning windows could be a decent side or full-time gig.

24Start a woodworking business

Do you love woodworking? Even without a huge workshop, you can create some of the more popular crafts and sell them. And like most things, your success in business isn’t necessarily related to how skilled you are as a woodworker. So if you can figure out which products consumers want and just create those, you could have a good business plan. Etsy.com and farmers’ markets are a great place to start selling.

25Candle-making

A few years ago I started making my own beeswax candles – because they were so stinking expensive to buy. In the process of learning, I found that there are a lot of people who use candle-making as a home business. You can sell to your products online at places like Etsy.com or Ebay.com.

26Massage Therapy

“The massage therapy business has been growing by leaps and bounds in the last decade, tripling in volume. According to the Bureau of Labor Statistics’ Occupational Outlook Handbook, it should grow by an additional 20% through 2016, meaning this home business has strong potential for growth. And, because all in-home massage services are necessarily local in nature, it’s work that can’t be outsourced to another country.”

27Clean Business Offices

A lot of small businesses need people to clean their offices and this is a business that you can start with a very small investment.

28Professional Pooper Scooper

Maybe not the most glamorous work, but in recent years I have seen many dog waste removal companies pop up, so there must be some money to be made.

29Senior Care Services

More and more seniors are wanting to avoid nursing homes in lieu of staying in their own homes. Offering non-medical home care by assisting the elderly with regular daily tasks could be rewarding and profitable.

30House Cleaning

I have known a few women carved out a flexible home-based business by cleaning homes. You probably already have the skills you need, now you just need to get the word out.

31Teach English (or other Language) Classes Online

Did you know that English speakers are in high demand in Asia? As a result many are turning to freelance English teachers using websites like Italki.com. The site is basically a virtual online classroom for freelance teachers and students. Anyone can offer lessons (and set their own price) and anyone can take lessons.

From a quick scan, it looks like making $15-20/hour is a fair expectation.

Need more home-based business ideas?

Here are a few more articles with even more ideas and opportunities…

- 20 Companies That Will Pay You To Work From Home

- The Top 25 Home-Based Business Ideas

- 23 Ways To Make Money

- Home business ideas

- Home Business Ideas for New Home Based and Small Business Entrepreneurs

- About Home Business