We help Christians live financially free and impact eternity

Learn to simplify, automate, multiply & get full control of the money you’ve been entrusted with. So you can pay off debt, stop fighting about it, & get on with your God-given purpose.

Take the first step by getting our Simple Money newsletter.

SeedTime has been featured in:

You can’t serve God and money, but you can serve God with money

As Christians, we have a different set of money rules. Yet most of us are unknowingly playing by the world’s rules and wondering why it isn’t working out.

We help you tap into the unfair advantage we (as Christians) have with our financial lives.

We help you quickly and easily get your money sorted out. Because you need to get on with your life and the work God has called you to without money getting in the way. Because we believe that you cannot serve God and money, but you can serve God with money.

If this resonates with you, we recommend grabbing our book, joining over 100k friends who get our Simple Money newsletter, and subscribing to our SeedTime Money podcast.

How we can help

Spend less time thinking about money and get far better results.

We focus on teaching our set-it-and-forget-it methods of managing money because we always prioritize simplicity. And in the 21st century, it is easier than ever to automate your way to financial success.

Experience true financial freedom

True financial freedom is less about yachts and private islands and more about being free to fulfill your God-given purpose. Money is simply a tool God provides to help us do the task He has given us. Sure, when you can afford it, get your private island and send us an invite 😉 but the key is always in seeking Him first, never the stuff.

Tear down the financial lies holding you back

Whether you make 30k a year or 3 million a year, you likely have financial beliefs that you have inherited that are holding you back from your financial potential. We help you break them once and for all and replace them with the empowering truth that will propel you forward.

Become truly free… because the world needs you to be

Guess what? This isn’t just about you. When you are free to follow your purpose, the by-product is that the world is blessed. And if that wasn’t enough, when you are in a better financial position, you have more to give and impact the world around you. And that is where we are going my friend.

Our Story

In 2001 I (Bob) was living off a nearly maxxed out credit card with only $7 in my bank account. I then found myself broken down in the middle of the road and stranded 1,000 miles from home.

I had no one to call, no money to solve the problem, and no clue how I had gotten into the mess I was in. I had reached my financial breaking point.

About the same time I (Linda) was living at home with my parents with a full-time job, and yet I was spending 150% of my income and racking up debt at a record pace. Debt collectors began calling, and I felt scared, alone, and clueless about what to do.

And just a few years later, we got married and combined our financial messes. Look, weren’t we cute?

We discovered a “formula” of sorts…

Out of our financial messes, as we began seeking wisdom, God began revealing a “formula” to true financial freedom. And it was counter to everything we thought we understood about money.

Over the years that followed as we implemented the strategies and methods we teach, we began moving forward financially. Finally broke the paycheck-to-paycheck cycle and actually had some money leftover at the end of the month. We began paying off credit cards, car loans, and ended up even paying off our mortgage.

All in all, over $400,000 of debt paid off. And to top it all off, we were able to reach a goal we had of giving $1 million by age 40.

To God be the glory.

We aren’t trust-fund babies. We are just two middle-class kids from Missouri who were complete financial messes who took the steps we teach to see a financial turnaround of epic proportions.

But this isn’t about us…

This is about you and the shortcuts.

Not everything has to be learned the “hard way.” It’s a whole lot easier when you can just learn from someone who is where you want to be. That way you get the shortcuts to your goals, all while avoiding the mistakes most people make.

And that is exactly why we are here.

4 ways we can help you achieve true financial freedom

1. Join over 100,000 others and get our FREE newsletter.

You’ll get our best tips to better automate, save, earn passively, and invest smarter without any guilt or shame. And a good dose of encouragement to keep you going on your journey.

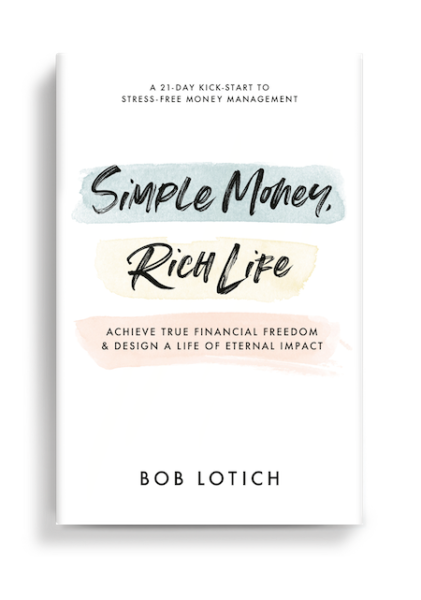

2. Get our award-winning book for FREE

Unlike any other financial book you’ve read, this is the operating manual we followed to pay off $400k of debt and give $1 million by age 40.

Join us as we share our best tactics and strategies, inspirational stories, Biblical wisdom, and some laughs. All without a hint of guilt or shame.

And for a limited time, we’d love to send you a copy for FREE if you can just help us cover shipping and handling. 👇

3. Get the Seed Time Money podcast

Join us as we share real-life case studies, encouragement, and our best secrets and tips to unlock your earning, saving, and giving potential. Listen anywhere you listen to podcasts or on YouTube.

4. Join over 5,000 others who’ve taken our courses.

From our best-selling budgeting alternative, to our passive investing course, to our on-demand class for churches and small groups our courses are quick and are the fastest way to get the biggest results.

By the numbers:

54,385,537

Visitors we’ve served with this website since 2007.

105,207

Amazing Youtube subscribers

11,635

Students who have enrolled in one of our courses.

42%

of our income is given away to various charities.

Follow us on Instagram

For daily inspiration and simple strategies to win with money, make sure to follow us. We are @seedtime and would love to connect with you there! And when you do send us a DM to say hi.