I am one of those people who loves checklists.

Especially when I want to make progress in a particular area but don’t exactly know what steps to take.

They tend to help me see the big picture a little bit clearer.

Below is my personal financial checklist that I have been following.

It covers many of the steps I have taken over the last decade that have helped me move from being a financial mess to having at least a little bit of an idea of what’s going on with my money.

Some of the listed items are bigger and will take a long time, and some of them are simple tasks that you can accomplish in a day.

Some will be relevant to your situation and some will not ”“ that is why it is called “personal” finance ”“ everyone’s situation is unique.

But, if you are just starting out and are trying to get yourself into a better position financially, I would suggest spending the next couple months checking off as many things on this list as possible.

If you do that you will be on your way to financial freedom!

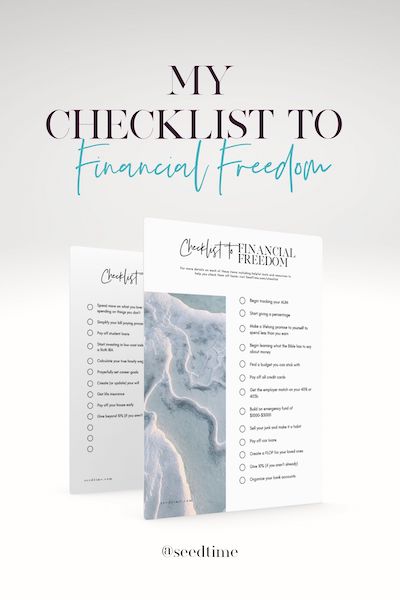

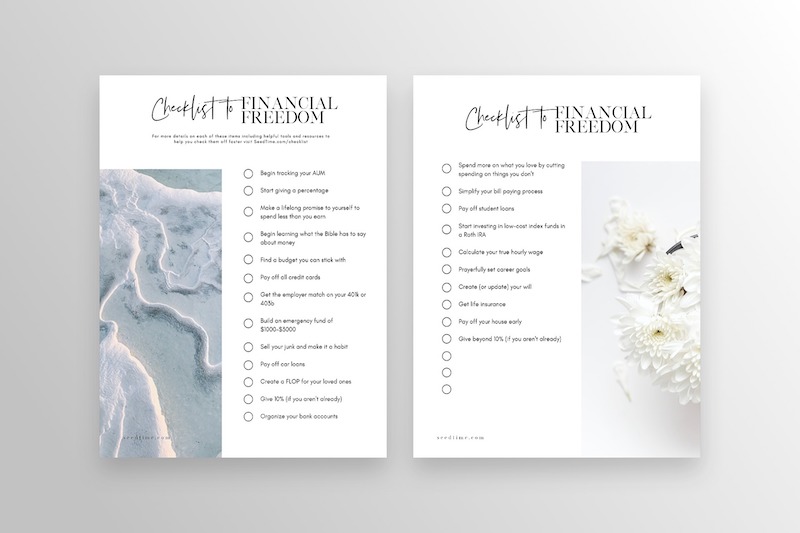

Want to print this financial checklist?

You can download this checklist as a PDF and print it for your own use if you’d like.

NOTE: This is not a chronological step-by-step process, but like the title suggests it is just a checklist.

Some of the items can be done simultaneously, while others will require another item to be checked off first.

Hope it helps!

My Personal Checklist to Financial Freedom

☑️ Begin tracking your AUM

This is commonly referred to as your Net Worth, but we stopped using that term and prefer the term AUM because we believe it is all His and we are just stewards managing what we have been trusted with. And that it is pretty insulting to define your total worth by a number.

But, all that said, tracking this number is the best way to measure your financial progress. So do it now if you haven’t yet. It might only take 10 minutes. Here is a quick video showing how.

☑️ Start giving a percentage

Something. Anything. If you don’t have a dollar to your name, give your time. Just get the sowing and reaping process started.

Genesis 8:22 says as long as the earth remains there will always be seedtime and harvest and you can’t reap what you don’t sow. So just like a farmer wouldn’t expect crops without planting seed, we too must start sowing in the area that we want to reap.

Though it seems counter-intuitive (like many Biblical principles), giving is one of the best things you can do for your finances.

☑️ Make a lifelong promise to yourself to spend less money than you earn

We could end this checklist right here and it would suffice.

Just about everything listed below falls into this category. Spending less than you earn is the key to wealth-building, and is the most important lesson when it comes to personal finance. You can do everything else right, but if you spend more money than you earn you will not be in a good financial position.

This is the simple rule that allows families living on a $40,000/year salary to retire with millions and that causes millionaires to go bankrupt. You have to commit and decide that you will not spend more money than you earn.

☑️ Begin learning what the Bible has to say about money

The Bible really has a lot to say about our money. I wrote an article called 5 Bible Verses about Money that Every Christian Should Know and if that isn’t enough, here are 250 Bible Verses about Money to get a deeper dive.

☑️ Find a budget you can stick with

Creating a budget can be as simple or as difficult as you make it. I love having a budget in place ”“ contrary to what I thought before I tried it, it doesn’t feel like we are in handcuffs, but rather that we are more free to spend money in the areas we want to.

We have a bunch of free free budgeting spreadsheets for excel you can download, but if you really want the best budgeting solution I have found, take our quick course to learn the Real Money Method. It is by far the quickest and easiest to stick with approach I have ever seen.

Once we found this method that we could actually stick with, it instantly improved our marriage, has saved us thousands of dollars, and given us so much more peace with our money.

☑️ Negotiate a better rate with credit card companies

While I was working to pay down my debt, I spent some time on the phone negotiating with my credit card companies to get a better interest rate.

It isn’t a guarantee, but I consistently would get off the phone with a better interest rate than when I called.

☑️ Pay off all credit cards

Proverbs 22:7 says that the borrower is slave to the lender.

Having been both a slave and a free man in this area, I much prefer being free. A wonderful second benefit is that you can build wealth faster when you are out of debt.

Here is a 23-page guide I wrote on how to pay off credit card debt.

For paying off debts, I recommend the Debt Snowball Method. Te speed the process up I also transferred all my CC balances to get 0% on all my cards.

☑️ Get the employer match on your 401(k) or 403(b)

If your employer has a matching program in your 401(k) or 403(b) (many of them do), you should try to take advantage of that if at all possible.

My former employer had a 100% matching program. So if I put in $500, they put in $500. That is a 100% return on my investment. It is free money and you don’t want to pass this up if at all possible.

☑️ Build an emergency fund of $1,000 – $3,000

This was another thing that we did to give us a lot more peace with our finances.

It can be expected that unexpected things will happen. Creating an emergency fund is just proof that you are expecting them.

We have since used our emergency fund to save us even more money.

☑️ Sell your junk and make it a habit

Way too many of us have way too much stuff. I recently read that the average U.S. household has over $7,000 worth of stuff that could be sold on Ebay or Facebook Marketplace. Not sure if it is true or not, but I have found from personal experience that we have a lot more than we realized.

In this article I show exactly how we made $2,145 in one month selling a bunch of our stuff from around the house.

A lot of it would never be missed if we got rid of it. Here is step-by-step instruction on how to sell on eBay if you have never done it before.

☑️ Pay off car loans

I am convinced that the one of the biggest things that keeps the middle class Americans in the middle class is their insistence on spending way too much of their income on cars. And it doesn’t have to be that way.

You don’t always have a car payment. You can still drive fairly nice (and extremely reliable) cars without having a car payment.

Once we paid off the first one, we just kept “making the payment” to our savings account and watched the savings grow. Once we had enough saved we bought the next car with cash, and we have been doing it that way ever since.

For more inspiration read How Cars Affect Your Financial Freedom.

☑️ Create a FLOP for your loved ones

Since I handle the finances in our family, I know a little more about what’s going on than Linda does.

I created this file, which I call our Financial Life on One Page (FLOP), as something that she could go to if I died prematurely. I combined it with our balance sheet (or AUM tracker) to make it one file that covers all the financial details that she would need if I were gone.

☑️ Start giving 10% (if you aren’t already)

Giving 10% of your income (or tithing) is an important milestone. God was the original giver and we were created by Him to be givers as well.

We have witnessed so many miracles in our life in the area of giving and it also happens to be the only place in the Bible where God says it is okay to test him ”“ see Malachi 3:10.

☑️ Better organize your bank accounts

I discovered that having more than one checking account allowed us to manage our money much cleaner and with more efficiency.

Here is a little on how we used to organize our bank accounts. To see how we do it today, check out the Real Money Method course.

☑️ Spend more on what you love by cutting spending on things you don’t

One of the things that most people fail to realize is that by cutting out the things you don’t really care about, you can free up more money to spend on what you love.

This requires you to question expenses, re-evaluate current mindsets, and possibly break bad habits, but it is worth it. I wrote about 25 ways to save money by not being “normal” which will get you started.

☑️ Simplify your bill-paying process

I tend to be obsessed with efficiency. And I hate wasting time. So I created a simple system for paying my bills each month to make it fast as possible all while virtually guaranteeing that I never accidentally miss a payment. It made my life a lot easier and eliminated a lot of stress.

☑️ Pay off student loans

Paying off our credit cards felt good, but man, getting those student loans off our back after all those years was such a relief.

For many of us it is a long hard road, but invite God in on our journey, and I believe you will see things move a lot quicker. Once you do read this article about how to get your student loans paid off faster and how you might be able to get your loans forgiven!

☑️ Start investing in low-cost index funds in a Roth IRA

A financial mentor of mine told me that the “Roth IRA is a legal loophole that is too good to last.” He is convinced the government is going to shut it down at some point, but in the meantime, we have the ability to take advantage of it.

Here are some ideas of how you can get started investing today or if you want a step-by-step instruction (down to the buttons to press) we created our 10x Investing course just for you.

☑️ Calculate your true hourly wage

This is a fantastic exercise to help you more accurately know what your time is worth and whether or not that job you have is worth it. Most people are blown away at home much they actually earn after factoring all the expenses that come with a normal job.

Try it here: How much are you really getting paid?

☑️ Prayerfully set career goals

Following up on the previous task, is the current job worth it? It is going to help you reach your career goals?

If you continue doing what you are doing, where will you be in 5 years ”“ or 20 years? Are you doing what you love?

If not, find someone doing what you want to do, take them out to lunch, and ask them how they did it.

☑️ Create (or update) your will

Save your loved ones a headache and just do it. We have an article about how you can create a will in about 10 minutes and for free.

Just mark it on your calendar for this weekend and be done with it.

☑️ Get life insurance

For most people I recommend buying term life insurance over whole life.

There are some cases where whole life can make sense, but generally term life insurance seems to be a better purchase for most people.

When I recently got another term policy I used Zander to get a term life insurance quote and was happy with the process. You can read more in my Zander Term Life Insurance Review.

☑️ Pay off your house early

As part of getting out of debt, I want to live without a mortgage as well. Here are some ways to pay off your house early.

Just imagine your electric bill being the most expensive bill each month!

☑️ Give beyond 10% (if you aren’t already)

The more I understand stewardship, the more I realize that every dollar that is in my bank account isn’t mine ”“ it is all God’s.

A big part of being a good steward is understanding this and never letting money get a hold on us. I am convinced that the most fulfilled people in the world are those who are always looking for ways to give more of themselves.

Time, energy, or money ”“ it is in our DNA to be givers and like the parable of the talents teaches us, if we are faithful with small amounts we will be entrusted with more.

God has led us on a journey of giving our age as a percentage of our income (currently 40%) which has stretched us, but the amazing blessings, miracles, and provision that we have seen since we began has been mindblowing.

We have found that R.G. LeTourneau’s words are true: “I shovel it out and God shovels it back. But God has a bigger shovel.”

The financial checklist

So this has been the checklist that we have followed to this point. Hopefully it serves as inspiration or a guide for you on your financial journey.

Please leave a comment below to say hi!

In Him,