We help Christians live financially free and impact eternity.

We do this by helping you save more by setting up a system that works… and earn more by working with your God-given gifts… and have more fun giving than you thought possible… and actually enjoying it all.

Featured in:

Our incredibly condensed story

Get the full story of SeedTime here, or read Bob’s story here.

What makes us different

Here are 5 things that make us different than pretty much everything out there…

1. We have an eternal perspective

The world’s way of handling money has failed us. The bookstore shelves are full of money books pushing the world’s greedy and flawed approach to money. Many don’t work, and those that do, help you succeed at the wrong thing. After all “what do you benefit if you gain the whole world but lose your own soul?” Matt 16:26

We help you not only succeed with money on earth, but do it in a way that you don’t lose your soul in the process.

2. This isn’t just theory, but strategies that work (within hours)

Far too many financial educators have a bunch of theory, but don’t have any real world practical steps to take to get real world results.

We believe in sharing the timeless Biblical principles, the mindset shifts you need to reach your financial potential, and the specific strategies to get results. All the parts work together, so why not share them all together?

3. We experiment with our money so you don’t have to

The internet is full of people “faking it until they make it”, trying to teach others how to do something they haven’t done themselves. Not here. We experiment on ourselves first, find what works, and then share with students. Not the other way around.

For example, I tried out dozens of budgeting approaches before creating our unique approach, opened up 34 credit cards to find the best one, and spent 10 years testing investing strategies before creating our investing course.

Oh, and everything we teach we are actually doing ourselves and so we are in it together.

4. We know money isn’t one-size-fits-all

Personal finance should be “personal” right? Everyone’s situation is unique, so rather than having one hard and fast set of rules that everyone must follow, we take a different approach.

We help you understand the principles, share the tactics that have worked best for us and our students, and then help you apply that to your specific situation.

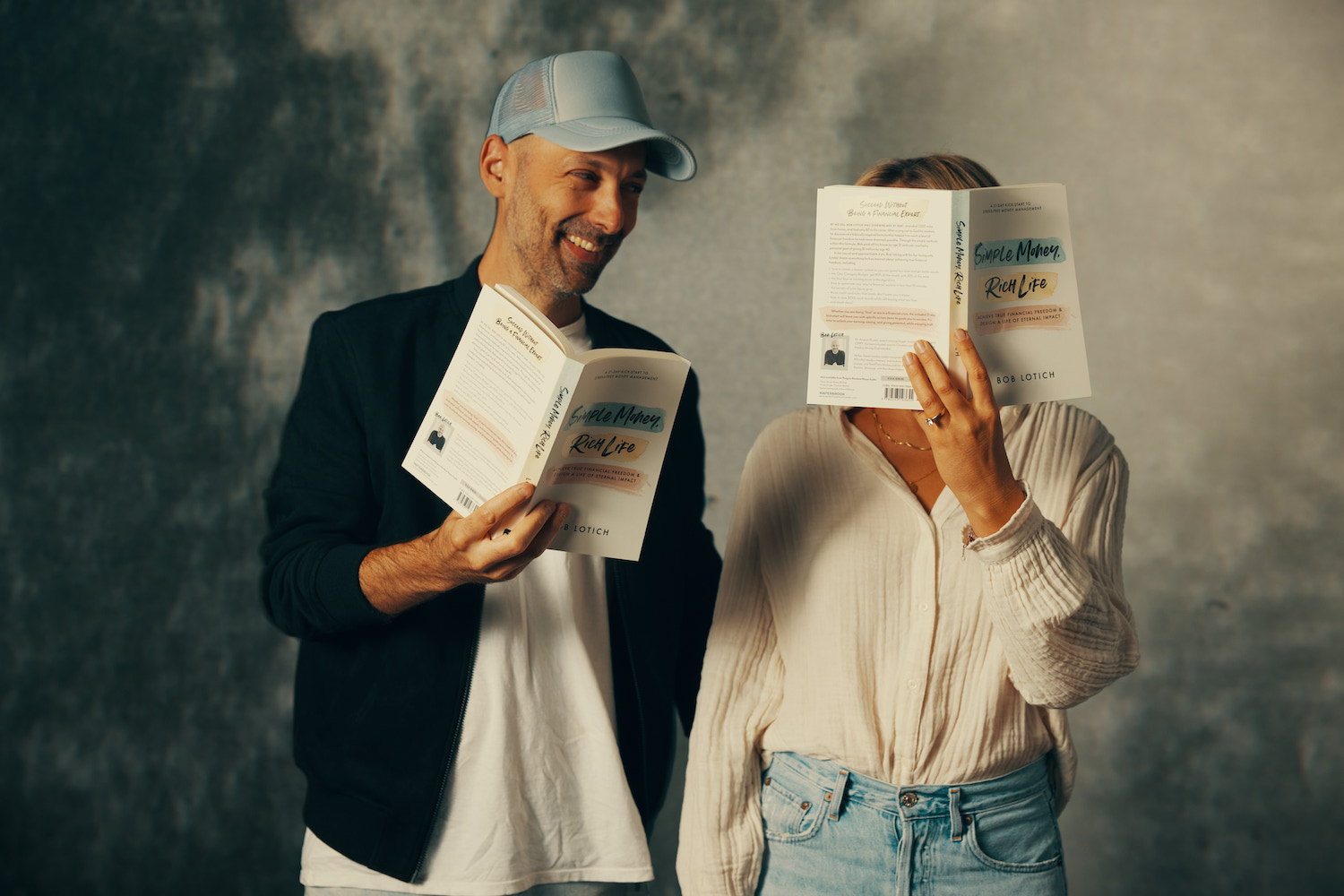

5. Linda = fun (need I say more?)

While I am officially a Certified Educator in Personal Finance (CEPF®), I am married to a Certified Spender of all our money.

She is a fireball, and we are so very different in how we deal with money, so this is real life. She is around to help you see things from a spouse’s perspective and to make sure we keep things light and fun.

Here is just a little of the fun in action.

Get the full story of SeedTime here or read Bob’s story here.

See what we’re about on Focus on the Family…

A few promises you have from us…

We will write about my financial successes and failures. There have been a lot of mistakes over the years, so we should always have some stuff to write about!

We will write my honest opinions and offer advice to you like you were a friend or little sister.

We will tell you what we’ve done that has worked and what hasn’t. We promise to keep things as simple as possible, making them easy for beginners to digest.

We will continue to learn! We fully realize that I have merely scratched the surface with learning about personal finance or even about God. We are passionate about both topics and particularly about how they work together. We really value the opinions of others and love to hear what others have learned.

Now what?

SeedTime is a community who views money as a tool to change lives, not the source of our status or security. Therefore, since money is a tool, we will be at our best and most effective when we learn (what we were never taught in school) how to manage, grow, spend, and give wisely.

Your first step is joining the over 100,000 others who have signed up for our newsletter.

You’ll get our best tips to better automate, save, earn passively, and invest smarter without any guilt or shame. And a good dose of encouragement to keep you going on your journey.

FAQs

Are you on social media?

Yes! You can find us here: Instagram & Youtube.

Can I interview Bob & Linda?

Probably. Find out more details on our Press page.

Do you have a statement of beliefs?

- Sure check it out here.

How Can I Help Support SeedTime?

Pray for us. Our heart’s desire is to use what God has entrusted us with to help more Christians get free with their money. Prayer works, and we could always use more!

Next, if you want to help us financially, you can support us by buying our book or courses for yourself or giving them away! Regardless of how you help, we are forever grateful!!

I Am A Mess Financially. Where Should I Start?

I suggest printing off my financial checklist and getting in our Real Money Method Course!

How can I find out more about Bob?

For more than you want to know, check out this page: Bob Lotich.

What Is Your Policy On Advertising?

SeedTime has grown over the years and now has 5 employees. We use advertisements to offset those costs. That said, I always have and will continue to only personally recommend or endorse something if I feel that it would be of value to some of the readers. If I find a product or service that has helped in my financial life, I will let you know about it. If a product or tool isn’t worth it, I will tell you that as well. The purpose of endorsing a product or service is for your benefit, not mine. I will tell you about the best products and services that I find regardless of whether I see any benefit from it. Find out more here.

Can I reprint some SeedTime articles?

Yes, you can reuse anything you find on this website (but not content from our courses) or our social media so long as you link back to the page where you found. Feel free to contact us if you have any further questions.

What’s next?

Take your first step and grab our book or newsletter.

You’ll get our best tips to better automate, save, earn passively, and invest smarter without any guilt or shame. And a good dose of encouragement to keep you going on your journey.

Tap the button below to get started: